Why wade through 100+ pages of unusable PDF-formatted Japanese jungle, when you can jump directly to the parts you want, read them in English, and quickly cut and paste both text and tables you want to analyze and compare? Why not save 70% of your time and conveniently review the official source documents submitted by all 3,600+ Japanese listed companies? Click on the center of the image below to view in full screen “flipbook” mode, and contact us at info@bdti.or.jp if you are interested to know more. Qualifying parties may receive demonstrations and trial accounts.

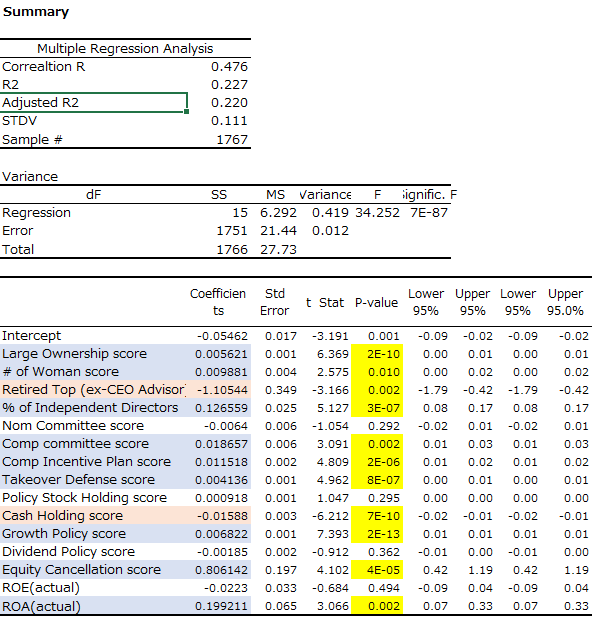

Ready or not, Japanese disclosure has now entered the age of machine-readable digital data! The dream that I presented to Japanese lawmakers in February of 2014 [1] can now be realized: a world where a Corporate Governance Code requires detailed disclosure of the inner workings of companies’ governance black boxes, and that information is seamlessly available to all investors, thus making it possible for them to do the analysis they must do to be good “stewards”. As a result, the Stewardship Code will be able to function in reality, not just in theory.

[1] 2月6日に自民党の日本経済再生本部の金融調査会に呼ばれて、コードの概念、政策としての位置付け、入れるべき内容の例を「日本経済の復活のため、コーポレート・ガバナンス・コードの早期制定を」というプレゼン資料を使って説明した。その後、議員らにさまざまなアドバイスと提供させていただいた。