Building “Director Power” with BDTI

Our Mission

“Provide effective training programs for all directors, both internally and externally, to acquire knowledge, skills, and mindsets related to governance, and contribute to strengthening corporate competitiveness, sustainability, and the development and evolution of the Japanese economy.” This is the mission of BDTI. We will continue to enhance the effectiveness of our courses by reflecting new societal demands and guiding more than 4,500 directors, director candidates, and those aspiring for better governance, careers through executive training.

Our History

The Board Director Training Institute of Japan (BDTI) was established in 2009. Founder and Executive Director, Nicholas Benes, advocated the introduction of the Corporate Governance Code (CGC) in 2013. Since its establishment, BDTI has been working with the mission of contributing to the sound and sustainable development of companies and the economy by improving the corporate governance of Japan companies, and this philosophy is deeply in line with the basic spirit of CGC.

Many top leaders, both in Japan and overseas, agree with the purpose of BDTI and support us in a variety of ways as advisors, collaborators, and donors.

The Corporate Governance Code

The principles of the Corporate Governance Code state that companies should provide and arrange for training and other activities so that directors and auditors can continuously acquire and update the knowledge and skills necessary to properly fulfill their roles.

▶ Click here for [Principle 4-14. Training of Directors and Statutory Auditors]. (Japanese)

Thoughts on Improving Corporate Governance

Mr. Kenichi Osugi, Representative Director of BDTI, and Mr. Nicholas Benes, Executive Director (Founder), discussed the background of the establishment of BDTI and the importance of corporate governance and executive training.

1. Self Introduction

Benes: My name is Nicholas Benes, Executive Director of BDTI, and after obtaining my MBA and US law license, I joined J.P. Morgan’s investment banking division, where I worked for 11 years on a variety of assignments and deals. After that, I started my own firm in Japan specializing in M&A advisory services, and I have been in Japan for 29 years. I have also served, and continue to serve, as an outside director of several companies, both listed and unlisted, including on Livedoor’s board post-scandal.

Osugi: I am Kenichi Osugi, also a Representative Director, and I became a Representative Director in 2013 from a non-representative director. At Chuo University Law School, I teach commercial and corporate law to students who wish to become legal professionals, while conducting research mainly in the areas of corporate law, corporate governance, and financial instruments and exchange law.

2. Purpose of Establishing BDTI

Benes: Since the collapse of the bubble economy, Japan’s economic growth has remained sluggish. Furthermore, the budget deficit has ballooned as the economy has been hollowed out due to a shrinking population and the offshore transfer of manufacturing. The road to economic revival is not an easy one.

▶ Click here to read the full dialogue.

Activity

BDTI’s activities are organized around three main pillars:

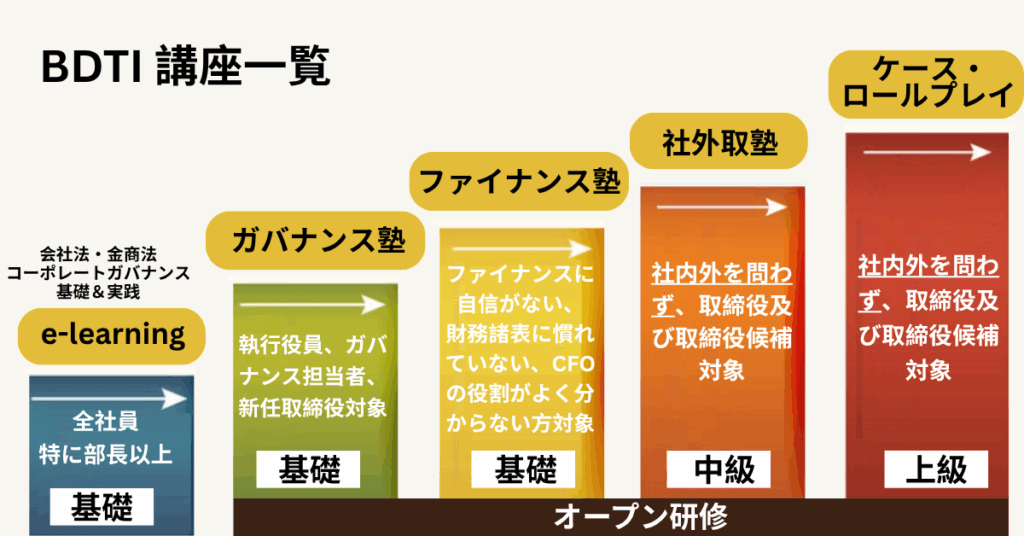

Open executive training:

Based on the “Governance School” held generally every month, “Finance School,” “Outside Director School,” and “Case Role Plays” are offered to strengthen “executive skills” that directors should have.

2.e-Learning

Through online courses that can be taken anytime and anywhere, students systematically acquire basic knowledge and mindset related to governance and corporate management.

3.Firm Training Programs

Customized training designed according to the individual issues and target audience of the company (or corporate group) to strengthen governance and improve the skills of executives.

Board of Directors

The members have been leading the development of corporate governance in Japan through their deep involvement in the formulation of the Corporate Governance Code or as members of the FSA’s “Study Group on Corporate Governance Systems”, where they were involved in the design of the system. The members include outside directors and corporate auditors of listed companies, institutional investors, university professors and human resource development consultants, and have deep knowledge in both theory and practice. For biographies, please refer to the following pages.

Our Supporters

Individuals, institutional investors, and organizations who have donated and supported the Board of Directors deeply agree with the Organization’s philosophy and purpose, which is to contribute to the strengthening of the competitiveness of Japan companies and the development of the Japan economy by improving the quality of decision-making at the Board of Directors and realizing sound and sustainable corporate governance.

We would like to express our heartfelt gratitude for your exceptional support.