”Russell Reynolds Associates recently interviewed numerous institutional and activist investors, pension fund managers, public company directors and other governance professionals about the trends and challenges that public company boards will face in 2017. Our conversations yielded a wide array of perspectives about the forces that are driving change in the corporate governance landscape.

Tag: Selective Disclosure

”Do Institutional Investors Demand Public Disclosure?” by Stephen A. Karolyi and Andrew Bird

”Do institutional investors demand corporate disclosure? A central question in finance and accounting is whether corporate transparency benefits or hurts investors. This issue is complicated by the fact that information provision could affect groups of investors differentially. Public information may crowd out the private information advantage of some institutional investors; alternatively, investors, particularly those following more passive trading strategies, may not be information sensitive. However, even passive institutional investors may benefit from an increase in monitoring by other stakeholders following improved disclosure. Further, regardless of the preferences of institutional investors, whether or not they are able to affect corporate policy on this margin is unclear. This tradeoff is reflected in mixed empirical evidence on the relationship between institutional ownership and corporate disclosure.

To address this tradeoff faced by institutional investors, we analyze the revealed preference for corporate disclosure by institutional investors and the associated impact on the information content of corporate disclosure. Empirically, identifying a causal effect of institutional ownership on corporate disclosure policy is difficult because experimental settings and direct measures of corporate disclosure quantity and characteristics are scarce. We propose a two-part solution to these problems. First, we utilize exogenous changes in institutional ownership around Russell 2000 index reconstitutions in a regression discontinuity design to identify the effect of institutional ownership on corporate disclosure policy. Second, we directly measure the characteristics of corporate disclosure using a novel data set composed of all 8-K filings between 1996 and 2006.

“How Japanese Companies are Navigating the Corporate Governance Code” (Speech to CII)

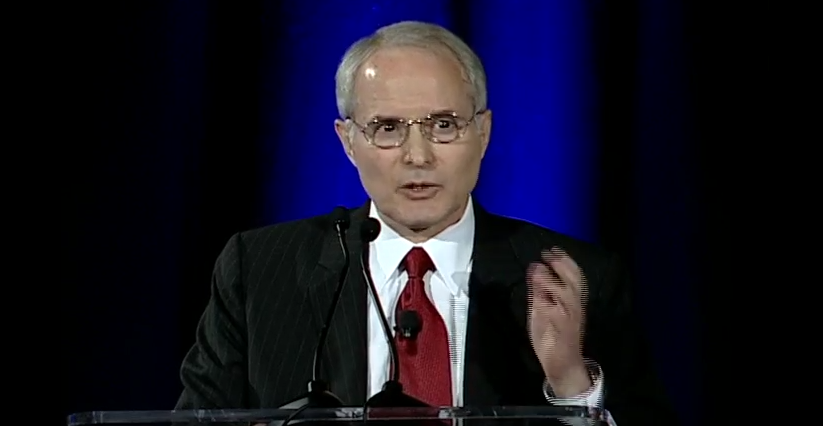

Here is the short speech that I gave to the Fall 2016 Conference of the Council of Institutional Investors (CII), on September 30, 2016. On this video, my speech starts at the 36:00 minute point. Below, I have reproduced the CII’s summary of my comments, and further below, the full text of my speech.

” Nick Benes, representative director for the Board Director Training Institute of Japan, said a sea change is underway in Japan in terms of companies beginning to comply with the Corporate Governance code, but there is still room for improvement. He reported that almost 80 percent of Japanese companies now have two or more independent directors and 40 percent of large companies have their own corporate governance guidelines, but beyond that, the reforms that companies say they have in place are lacking in substance. He estimated that 90 percent of firms say they comply, but have little evidence this is the case and few have actually changed their practices. Despite these setbacks, Benes said he remains optimistic that Japanese companies will move in the right direction because there is now broad awareness that “governance is good”. Additionally, disclosure has vastly improved and the number of votes opposing the re-election of directors is climbing. A video of this session is available here.

Text of Speech (and Slides)

“In 2013, I was lucky enough to propose to key congressmen in Japan, that Japan should have a Corporate Governance Code. I then advised them, and then the Financial Services Agency, about the content of the Code.

So I am very pleased to have this opportunity to summarize the progress that Japanese companies have made so far in implementing the principles of the Code, based on my activities as consultant, independent director, “directorship” trainer, and policy advocate.

My main message to Committee members is this:

1) A sea change is underway in companies, the media, the government, and the public. Because Japan is a “shame-based” society, the vastly enhanced disclosure required by the Code has created a strong virtuous circle.

2) These changes represent a very big opportunity for foreign investors, but only IF they study the Code and the disclosures in detail, and then leverage the Code’s principles so as to make specific requests for better governance practices to Japanese companies they invest in, while also brandishing the possibility of consequences – such as not re-electing senior executives, – if progress is not made.

Here are some highlights “from the trenches” about what is occurring in Japan:

Prof. Sean J. Griffith: ”Corporate Governance in an Era of Compliance”

”Abstract: Compliance is the new corporate governance. The compliance function is the means by which firms adapt behavior to legal, regulatory, and social norms. Formerly, this might have been conceived as a typical governance matter to be handled at the discretion of the board of directors. Compliance, however, does not fit traditional models of corporate governance. It does not come from the board of directors, state corporate law, or federal securities law. Compliance amounts instead to an internal governance structure imposed upon the firm from the outside by enforcement agents. This insight has important implications, both practical and theoretical, for corporate law and corporate governance. This Article pairs a detailed descriptive study of the contemporary compliance function with a normative account of its incompatibility with current conceptions of corporate governance. It argues that compliance alters the political economy of American business, challenges governance efficiency, and makes old theories of the firm new again. Prescriptively, the Article calls for greater transparency and a more limited role for government in designing corporate governance mechanisms………”

”Shareholder Activism & Engagement 2016”

US Department of Justice (Speech at Yale): ”Individual Accountability for Antitrust Crimes”

Such fines have occasionally sparked a debate about whether corporate accountability and corporate fines are a meaningful punishment for antitrust crimes. For instance, I participated in a panel discussion on this topic at the Bundeskartellamt’s Berlin Conference last year. During the discussion, a panelist provocatively suggested that competition enforcers are “drunk on fines” and suggested that corporate fines are not serving their intended deterrent purpose.

Grand Total of 15 Companies Submitted English Corporate Governance Reports to TSE in Past Year

Only 15 companies have submitted English language Corporate Governance Reports to the TSE in the past 12 months…even though the CG Code asks companies with many foreign investors to consider that. We need significantly more than 15. Boys be [more] ambitious! But recently I was able to convince the TSE to at least make a list of the companies that DO have English reports, so that we can single them out for praise. You can find the list on a downloadable Excel file on this page.