By Nicholas Benes

The short story: it will not be so hard if institutional shareholders really want to topple it, and use the technique suggested here. But first, the background.

Background

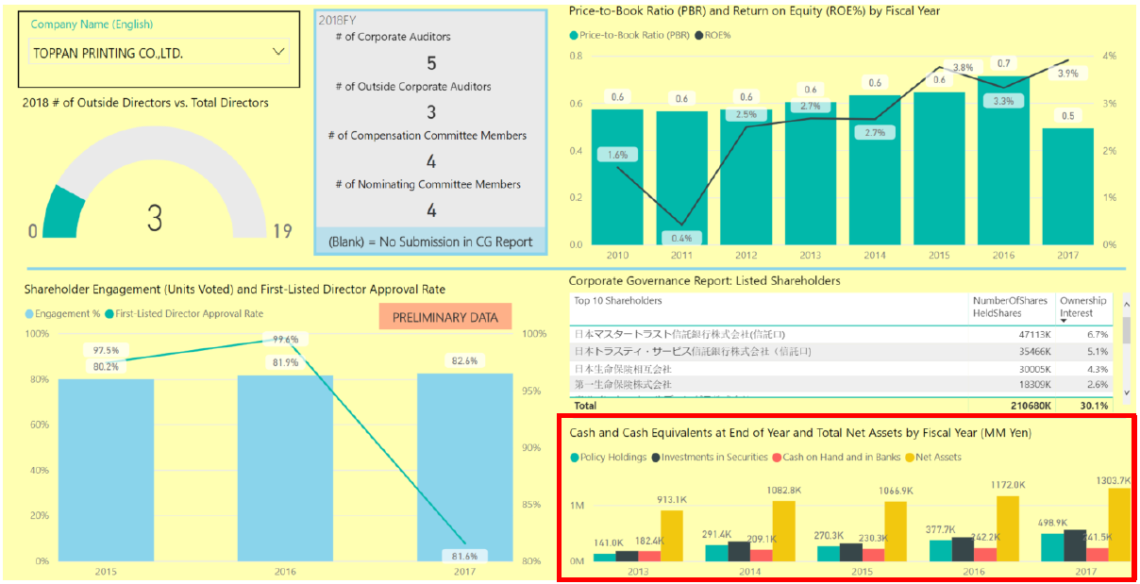

This is still the biggest defect of Japan’s equity market, and recent reforms have only made a small dent in it. At the average listed company, between 35% and 50% of the stock is owned by such holders if one includes not only firms in “cross-shareholding” relationships but also firms that unilaterally hold stock in order to win business; most holdings by

banks and insurance companies; and parent companies, subsidiaries, and affiliates. Consistent with this estimate, when Japanese listed companies were asked, “what percent of your shareholders can you count to support management?” in late 2017, fully more than two-thirds of companies responded with numbers in the 30-60% range.

These “policy holdings” by “stable shareholders” represent a massive misallocation of capital that is being put at risk largely for the purpose of protecting executive teams at other companies. In 1967, Japan’s one of Japan’s most venerated managers and the founder of Panasonic, Konosuke Matsushita, minced no words in noting his concern about the then-recent rise of “stable” cross-shareholdings in these words: “If this situation continues, I think it is in no way desirable, because of the risk that once again a maldistribution of capital in our country will occur. I believe that this is not a sign of progress in capitalism; rather, it should be considered as a sign that we are moving backwards.”