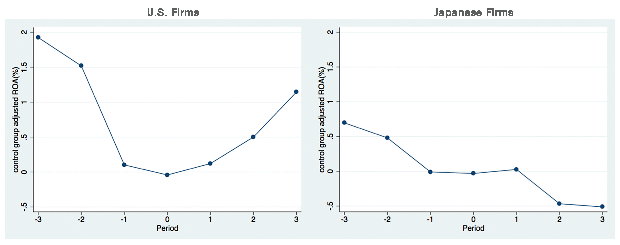

Figure 2: Return on Assets Before and After Corporate Leadership Change

Hyeog Ug Kwon, Faculty Fellow, RIETI: ”Japanese firms invest in research and development (R&D) on a level comparable to that of their U.S. counterparts. They possess a high-quality workforce and receive decent management practice scores for organizational and human resource (HR) management. Yet, they fall significantly behind U.S. firms when it comes to earning power. Figure 1 below, which I calculated along with Senshu University School of Economics Associate Professor Kim Young Gak, plots the average ratio of operating income to sales for Japanese, U.S., and South Korean listed companies from 1955 to 2006. As it shows, the operating income ratio of Japanese firms never surpassed that of U.S. firms over the entire 50-year period, and trended downward until 2003……..”

Figure 1: Average Operating Income to Sales Ratio

Continue reading using link below: http://www.rieti.go.jp/en/columns/a01_0432.html

Source: Research Institute of Economy, Trade & Industry, IAA