In light of the attention AVI’s shareholder proposal is drawing toward TBS’ huge “non-core” shareholdings in Tokyo Electron, and the light this is shedding on the continued practice of cross-shareholdings in Japan, we thought it would be helpful to screen for companies with similar characteristics.

AVI’s argument draws on solid corporate finance principles that companies should not be diversifying for shareholders when they can do so for themselves in a more efficient manner. Moreover, even when the company is suited toward asset management and has a solid track record for this (e.g., Softbank), investors expect to see behavior that shows that the (quasi) asset manager is exercising judgement as such on an ongoing basis. In other words, the company should exhibit buying and selling activity dictated by profitability and outside forces. In such cases, shareholders tend to view and value the company more as an asset manager than as a company in the originally-stated industry, and therefore expect such behavior.

When the investments in a company, such as Tokyo Electron by TBS, have no seeming strategies except to “hold” through thick and thin (in this case, for 54 years so far), it calls into question why the company continues to hold them. When the value of these assets exceeds a significant threshold, it becomes a matter of corporate governance and fiduciary duty by investors to not ask this question, and likewise, it becomes a matter of corporate governance and fiduciary duty if the company cannot respond with convincing reasons that are in line with its stated business strategy.

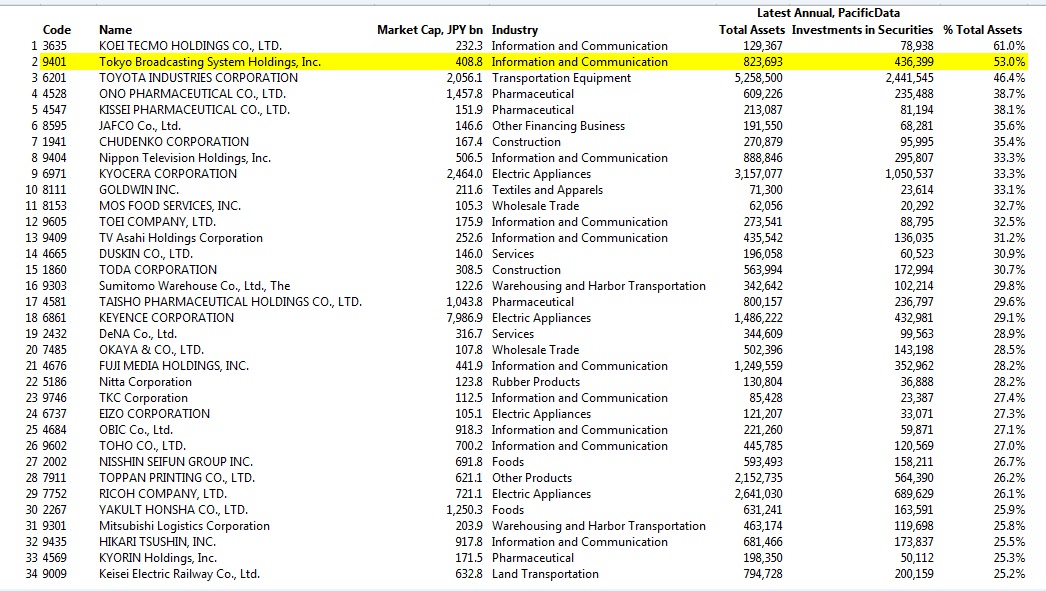

Below, we have identified the 34 publicly-listed companies in Japan with a market cap over JPY100 bn and Investments in Securities greater than 25 percent of their Total Assets:

(Source: PacificData)