Such fines have occasionally sparked a debate about whether corporate accountability and corporate fines are a meaningful punishment for antitrust crimes. For instance, I participated in a panel discussion on this topic at the Bundeskartellamt’s Berlin Conference last year. During the discussion, a panelist provocatively suggested that competition enforcers are “drunk on fines” and suggested that corporate fines are not serving their intended deterrent purpose.

Congressional Research Service: “Obstruction of Justice: An Overview of Some of the Federal Statutes That Prohibit Interference with Judicial, Executive, or Legislative Activities”

”…………….Obstruction of justice is the impediment of governmental activities. There are a host of federal criminal laws that prohibit obstructions of justice. The six most general outlaw obstruction of judicial proceedings (18 U.S.C. 1503), witness tampering (18 U.S.C. 1512), witness retaliation (18 U.S.C. 1513), obstruction of congressional or administrative proceedings (18 U.S.C. 1505), conspiracy to defraud the United States (18 U.S.C. 371), and contempt (a creature of statute, rule and common law).

FCPA Blog: “Former Olympus USA Compliance Chief Collects $51 Million for Blowing the Whistle on Global Bribes”

“First-hand details of the global pay to play kickback scheme at Olympus were brought to the government’s attention by the company’s former corporate compliance officer. John Slowik filed a federal lawsuit in New Jersey under the qui tam or whistleblower provisions of the False Claim Act and similar state laws. Lawyers at the Kenney McCafferty law firm represented the whistleblower.

Jiji Press: “3 Ex-TEPCO Execs Indicted over March 2011 N-Disaster”

“Tokyo, Feb. 29 (Jiji Press)–Three former executives of Tokyo Electric Power Co. <9501> were forcibly indicted Monday by court-appointed lawyers serving as prosecutors over the unprecedented triple meltdown at its Fukushima No. 1 nuclear power plant.

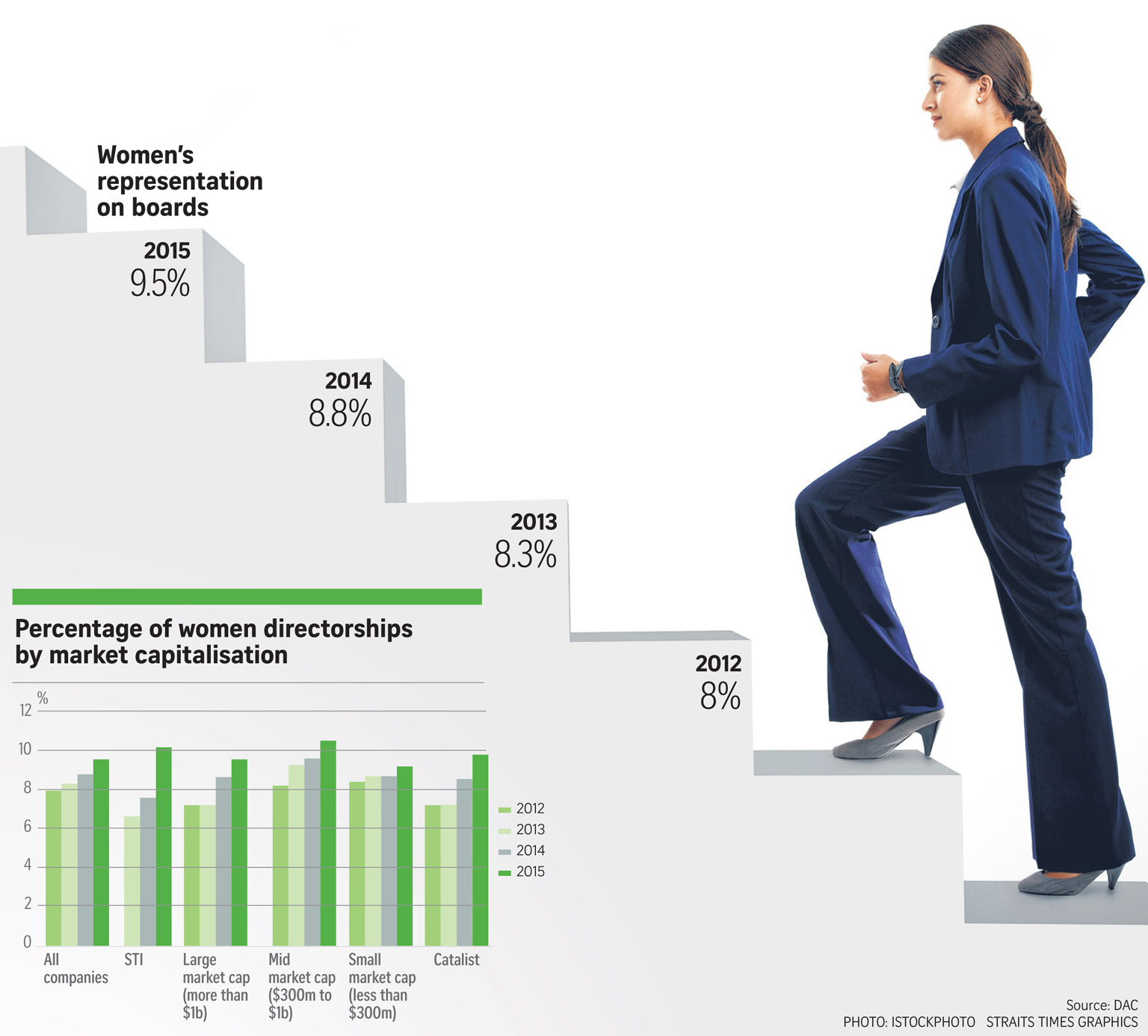

Diversity Action Committee: ”Women stepping up in Singapore boardrooms”

”Singapore’s top companies have led from the front in helping to remedy one of the blights on the local corporate scene – the under-representation of women on company boards.

A new report has found that across the 30 listed companies comprising the blue chip Straits Times Index (STI), 10.2 per cent of board seats were held by women last year, up from 7.6 per cent in 2014.

Report: ”Does CEO succession Planning Disclosure matter?”

IRRC INSTITUTE New Report by Annalisa Barrett, Founder and CEO of Board Governance Research LLC. Successful CEO transitions Correlate with More Robust Disclosure, but Succession Planning Disclosure Frequently is Non Existent and Often Inconsistent – A US perspective Executive Summary: ”Shareowners and other stakeholders have been calling for more information about CEO succession planning. This […]

”The 100 Most Overpaid CEOs: Take Action”

Forbes: ”The Acquisition Of Japan’s Sharp By Taiwan’s Foxconn’s Historical Significance”

”The outcome of the acceptance by Japanese electronics giant Sharp of a USD $4.3bn takeover bid by Taiwanese multinational Foxconn remains to be seen. Its symbolic significance however could be quite extraordinary: will Japan’s notoriously insular economy, notably its notoriously ultra-insular electronics industry, be opening up to the outside world and especially to its East Asian neighbors?

JETRO Survey: ”Foreign Companies to Increase Japanese Operations”

”The Japan External Trade Organization (JETRO) is a government-related organization promoting mutual trade and investment between Japan and the rest of the world. It offers foreign investors abundant information on all aspects of doing business in Japan, by providing expert consultation and offering free temporary office space in major business areas across the country.

Last week, JETRO published the first issue of its JETRO Invest Japan Report (2015).

This report is a comprehensive survey on the attractiveness of the Japanese market and activities and perceptions of foreign affiliates in Japan. It also introduces the situation of foreign direct investment in Japan, trends on policies related to investment promotion and improvement of business environment, as well as JETRO’s activities to promote foreign direct investment.

Davos 2016 – Issue Briefing: Ethics and Corporate Governance (Video)

Learn first-hand about how corporate governance can ensure that high ethical standards are met to restore trust – Video