On December 11, 2019, I gave a lecture on BDTI’s analysis about corporate governance practices and and firm performance in Japan. Since then we have added indicators of statistical significance to our materials. To view the entire presentation as translated into English, click here: Presentation to Securities Analyst Association 2019.12.11. Those who read Japanese can read the full speech here, and can download the Japanese version of the presentation materials.

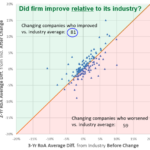

Our methodology is shown on page 23 . Our analysis suggests that the adoption of the following practices leads is followed by (appears to cause) improvements in ROA compared to the average for a firm’s industry over the next two years. Please see the charts on the left side of each page:

- Adding an nomination committee of some sort (p. 27)

- Appointing an outside director as the chair of that committee (p. 28)

- The combination of nomination committee with a board composition with >33% independent directors (p. 30)

- Adopting a performance-linked compensation plan for executives (p. 29)

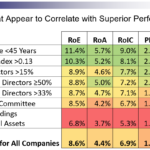

Various other factors that appear to correlate with superior performance, are shown on page 22, and page 34. We will explore the direction of causation with some of these later.