An in-depth interview with Mr. Tsuyoshi Maruki, who established Strategic Capital, Inc. in September 2012, was one of the Founding Partners of M&A Consulting (Japan’s first activist fund), and once worked “on loan” at METI (when it was known as “MITI”).

Tag: Cross-shareholdings

”Investors Vocal at Scandal-Hit Firms”

”Wednesday marked a peak time for this year’s general shareholders meetings among major listed firms in the nation, with severe criticisms voiced one after another toward the management of companies involved in scandals, including Mitsubishi Motors Corp. Many shareholders also raised concerns about future business performances in response to Britain’s decision to leave the European […]

”Corporate governance report card”

”Japanese companies appear to be steadily implementing the corporate governance code introduced by the Tokyo Stock Exchange a year ago, at least in form. Of the 2,018 firms listed on the first and second sections of the TSE, 78 percent say they are now in compliance with at least 90 percent of the principles set […]

Discussion Paper by Hideaki Miyajima et al : ”Does Ownership Really Matter?: The Role of Foreign Investors in Corporate Governance in Japan”

”Abstract. After the banking crisis of 1997, corporate ownership in Japan shifted from an insider-dominated to an outsider-dominated structure. This paper analyzes the impact of dramatic changes in the ownership structure on corporate governance and firm value, focusing on the role of foreign institutional investors. There are two competing views on the role of increased foreign ownership. The positive view is that foreign investors have had high monitoring capability, and encourage improvements in the governance arrangement of firms, resulting in higher performance.

HBS Professors: American Managers Seek to Avoid Legitimate Shareholder Proposals

In this paper, HBS Professors Suraj, Srinivasan, and Vijayaraghavan analyze the period 2003-2013 and conclude that US managers often seek to avoid listing legitimate shareholder proposals in the proxy materials. This is a stark contrast to the situation here in Japan, where executives must include virtually any shareholder proposal in the proxy, even if strange or rude.

Research by Ahmed Zemzem: ”Japan’s Corporate Governance Structures and Credit Rating”

‘‘Abstract: The aim of our research is to investigate whether good governance is associated with higher credit rating in Japanese firms. Mainly, this research seeks to examine the effect of governance attributes namely those related to the board and ownership structure besides quality of information on credit ratings. Empirical analyses are conducted from a sample of 75 Japanese firms listed on Topix 100, over the period 2006- 2013 using Ordered Probit regression. The study shows that good governance is associated with higher credit rating and suggests that active monitoring by independent directors and better disclosure mitigate agency conflicts and protect the interests of debtholders……”

Citywire: ”Japanese value is not dependent on a weak yen”

”The Japanese equity market has been under pressure recently from a strengthening currency, a weakening global economy and the uncertainty caused by the Bank of Japan’s introduction in late January of a negative interest rate policy. We recognise these concerns, but think that the fears of many market participants are overdone.

As value investors we still see Japan as a fertile hunting ground.

A far greater percentage of listed companies have net cash on their balance sheets in Japan than in any other major market and net cash represents a greater percentage of market capitalisation, as shown below. Furthermore, many of those companies have significant unrealised gains on real estate holdings; and many have large holdings of listed equities, some for strategic business purposes, but some for no reason other than historic relationships.

The question that has occupied the minds of value investors like us has been how that value can be unlocked, used more efficiently and returned to investors when not needed for operational purposes. In that regard, we think that 2015 was a pivotal year for listed Japanese companies.

Discussion Paper by Miyajima & Ogawa: ”Convergence or Emerging Diversity? Understanding the impact of foreign investors on corporate governance in Japan”

”Abstract: The increasing share of foreign institutional investors has been a global phenomenon for the past few decades. Corporate ownership in Japan shifted from an insider‐dominated to outsider‐dominated structure after the banking crisis of 1997. On the role of increasing foreign ownership and its consequences, there are two competing views. The first view, or convergence view, is that foreign investors have high monitoring capability, and encourage improvements in the governance arrangements of firms, resulting in higher performance. Conversely, the skeptical view insists that they have a strong bias in their investment strategies and are less committed to a firm. Even though a correlation between foreign ownership and corporate polices and high performance could be observed, it could be superficial. Higher stock returns can be induced by their order demand, while performance can simply reflect foreign investors’ preference for high quality firms. To answer which view is more persuasive, this paper analyzes the impact of dramatic changes in the ownership structure on corporate governance, corporate policies, and firm value, with a focus on the role of foreign investors, particularly in Japan…………..”

Yumiko Miwa et al ”Professional Asset Managers and the Evolution of Corporate Governance in France and Japan: Lessons from a Questionnaire Survey”

”Abstract – A corporate governance system consists of a set of mechanisms which restrict managerial discretion. The constraints on managerial discretion in the Anglo-Saxon environment, considered as a benchmark, are usually described as being primarily driven by shareholder interests, whereas the French and Japanese systems are traditionally thought of as more stakeholder oriented. However, the increasing share of international ownership has had a significant impact on corporate governance in both countries over the last two decade

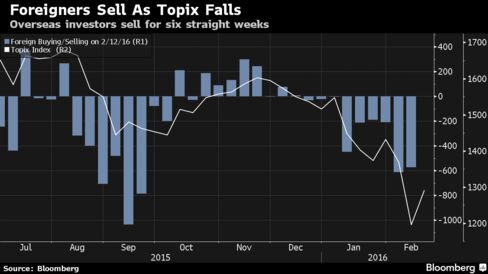

Bloomberg: ”BlackRock Is Betting on Japan Stocks as Other Foreigners Flee”

”As foreign investors flee Tokyo stocks, the world’s largest asset manager says the move by the Bank of Japan that spooked the market will be one of the main things that pushes it back up.