“Policy Stockholdings”

Many companies set the fiscal year to end at the end of March and hold their AGM in June. Those companies file Yuho financial reports by the end of June. According to the Yuho reports, we are able to lots of new data at this time. Among the data, in this post we will focus on ”policy stock” holdings, also known as “allegiant shareholdings”.

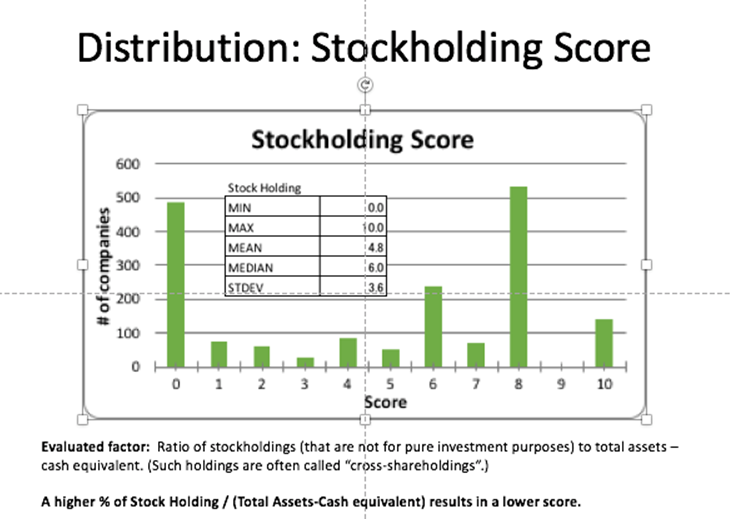

The average holding of “policy stocks” was JPY34,861 million for 1,775 companies, which has come down 13.7% from JPY40,389 million a year as the average of the 1,794 companies in our universe. Of course, we should carefully analyze these numbers, but the decrease of the stock holding was larger than the change in the stock index Topix for the same period. The Topix fell 7.3% from 1,716.30 on March 31 2018 to 1,591.64 on March 31 2019.

However, policy stockholdings remain high compared with the total assets or revenues of companies. On average, these stock holdings account for 2.6% of the value of [total assets less cash holdings], or 7.3% of the revenues as of March 31 2019, while the stock holdings as a percent of [total assets less cash] was 2.6% and that per sales was 8.8% as of March 31 2018. We should keep a close eye on the holding of policy stocks as well as cash. As corporate profit growth slows this year, the asset magnitude and utilization of those assets will directly impact the return on shareholders’ equity.

You can download our full report for June here.

Please see detail research the following links.

http://www.metrical.co.jp/

Please feel free to contact the below email address if any interest or query.

Aki Matsumoto, CFA

Executive Director

Metrical Inc.

akimatsumoto@metrical.co.jp

http://www.metrical.co.jp/jp-home/